Market with Protection Orders

This order type is useful for futures traders using Globex. A Market with Protection order is a market order that will be cancelled and resubmitted as a limit order if the entire order does not immediately execute at the market price. The limit price is set by Globex to be close to the current market price, slightly higher for a sell order and lower for a buy order.

Please note that this order type is not available in TWS PaperTrader.

Notes:

The Reference Table to the upper right provides a general summary of the order type characteristics. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. For example, if Options and Stocks, US and Non-US, and Smart and Directed are all checked, it does not follow that all US and Non-US Smart and direct-routed stocks support the order type. It may be the case that only Smart-routed US Stocks, direct-routed Non-US stocks and Smart-routed US Options are supported.

| Products | Availability | Routing | TWS | ||||

|---|---|---|---|---|---|---|---|

| Futures |  |

US Products |  |

Smart |  |

Attribute |  |

| FOPs |  |

Non-US Products |  |

Directed |  |

Order Type |  |

| Globex Only |  |

Time in Force |  |

||||

| View Supported Exchanges|Open Users' Guide | |||||||

Example

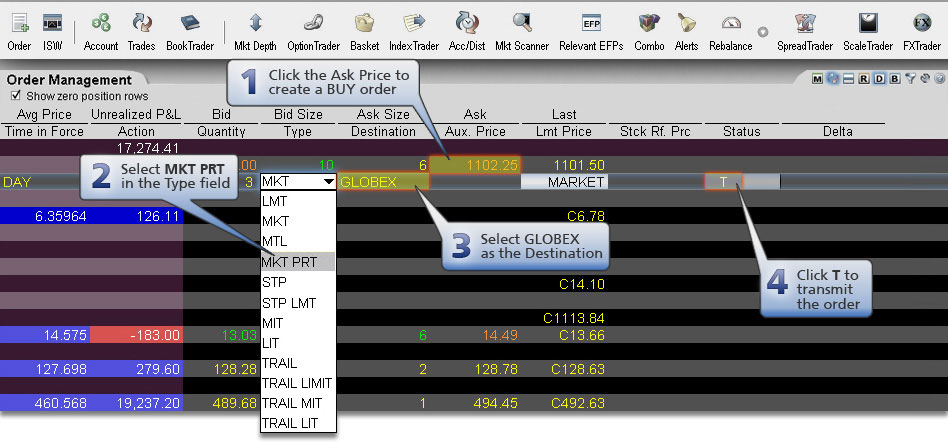

Order Type In Depth - Market with Protection Buy Order

Step 1 – Enter a Market with Protection Buy Order

You place a Globex-directed futures order to buy 3 March contracts, with the current market price at $1102.25. Select MKT PRT in the Type field to specify a market-with-protection order. Submit the order. If the entire order does not immediately execute at the market price, the unfilled portion of the order will be cancelled and resubmitted as a limit order.

Step 2 – Order Transmitted

You've transmitted your market with protection order. If the entire order does not immediately execute at the market price, the unfilled portion of the order will be cancelled and resubmitted as a limit order.

| Assumptions | |

|---|---|

| Action | BUY |

| Qty | 3 |

| Order Type | MKT PRT |

| Market Price | 1102.25 |

| Limit Price | MARKET |

Step 3 – Order is Partially Filled as a Market Order

One contract executes at the market price of $1102.25. The rest of your order is cancelled, but will be resubmitted as a buy limit order at a limit price set by Globex, slightly lower than the market price for a buy order.

| Assumptions | |

|---|---|

| Action | BUY |

| Qty | 3 |

| Order Type | MKT PRT |

| Market Price | 1102.25 |

| Filled | 1 contract |

| Order for the remaining two contracts is cancelled and will be resubmitted at the Globex-defined limit price. | |

Step 4 – The Rest of the Order is Filled as a Limit Order

The cancelled portion of your order, two futures contracts, has been resubmitted as a limit order. The order fills at 1102.25.

| Assumptions | |

|---|---|

| Action | BUY |

| Qty | 2 |

| Order Type | LMT |

| Limit Price | 1102.25 |