Interactive Brokers | NEWs @ IBKR Vol. 21

News @ IBKR

2023 - Volume 21

IBKR Advantage

IBKR Mobile:

Improved Navigation for

Traders On-The-Go

Expanded Offering

Interactive Brokers Introduces Stock Yield Enhancement Program (SYEP) Derivatives for Australian Wholesale and Professional Investors

IBKR Advantage

IBKR Clients Earn Up to 4.83% on Instantly Available USD Cash Balances

NEW TOOL

Fundamentals Explorer Now Includes a Securities Lending Dashboard

NEW TOOL

New Services for

Advisors of Any Size

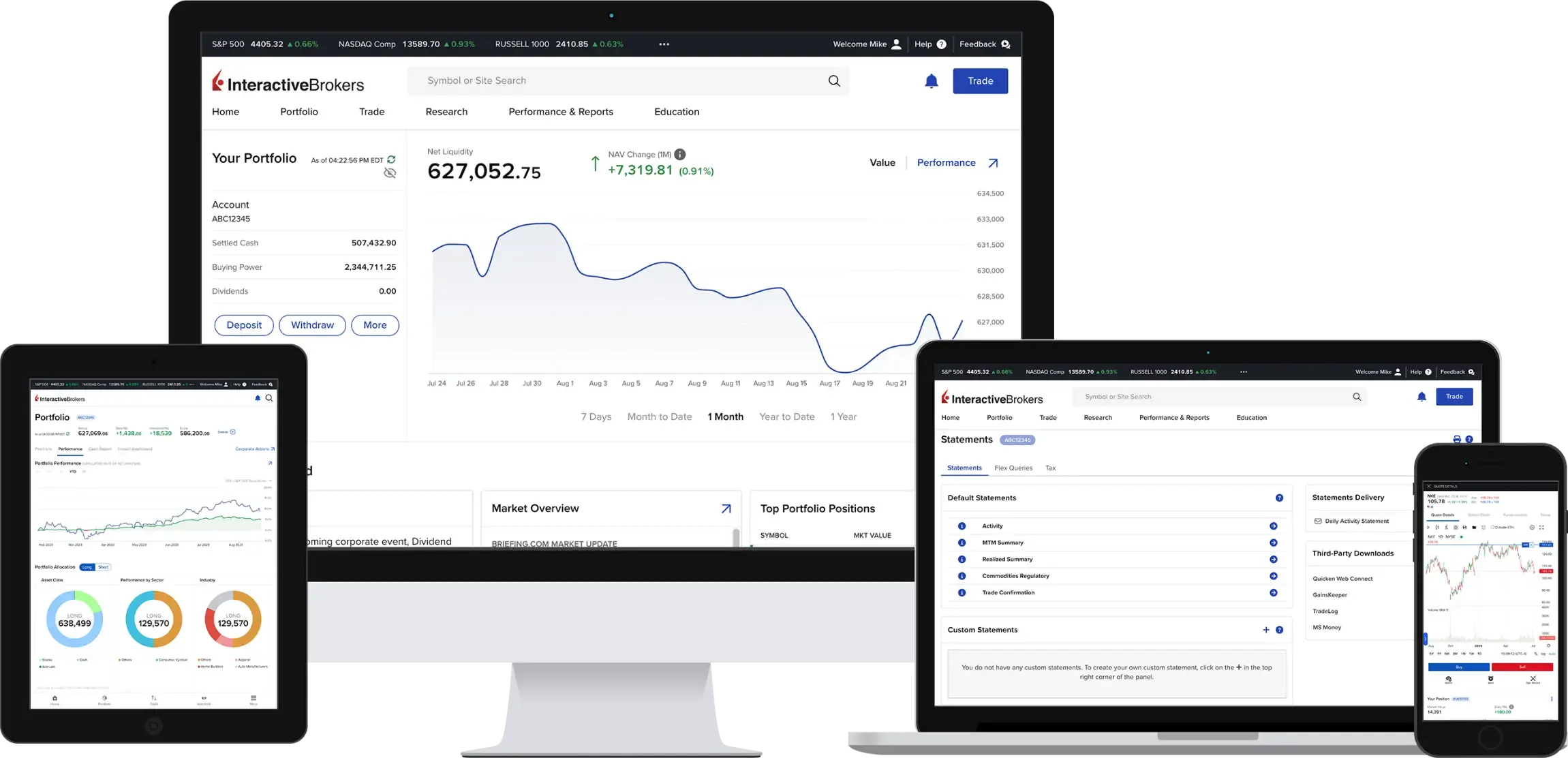

Interactive Brokers offers turnkey solutions that help advisors of any size build competitive advantage, efficiently manage their business and serve clients at low cost.

NEW TOOL

New Services for

Advisors of Any Size

DocuSign for Multiple Applications

Client Management Programs

for Advisors are Going Global

- Operational Control: These new models allow you to complete various tasks, such as funding requests and information changes, on behalf of your clients. Depending on the program, IBKR will accept the changes or once entered by the advisor, clients will use a simplified process to approve, sign and confirm your action.

- Enhanced Dashboard: We have enhanced the Client Pending Items tab (formerly Pending Items) on our Dashboard. This tab will show you all pending tasks for your clients and either allow you, as the advisor, to complete the task on behalf of the client or send an automated email asking your client to address the task.

- Improved Messaging: We have redesigned our Sub Account Messages tab and streamlined communications from IBKR by aggregating, categorizing and routing messages to the advisor to avoid unnecessary client contact.

- Streamlined simplifies the process by which clients approve funding requests, sign agreements and confirm changes and instructions entered by their advisor. Advisors can customize specific features, and communications from IBKR are aggregated, categorized and routed to the advisor to avoid unnecessary client contact. Once you enroll, all clients are automatically enrolled.

- Streamlined Plus allows advisors to perform certain administrative tasks on behalf of their clients. Once you are approved for participation, clients will automatically be enrolled during the application process with the same advisor authorizations applying to all.

- Full-Service clients enroll individually and choose the powers they wish to grant their advisor, which can include moving funds or assets on their behalf and performing a broad range of administrative tasks.

NEW PRODUCTS

New Products Available on

the Interactive Brokers Platform

CME Group

- Monthly and Weekly Options on Micro Gold Futures (OMG, 1-5MG, 1-5WG, 1-5FG)

- 13 Week US Treasury Bill Futures (TBF3)

- Crude Oil Mon & Wed Weekly FOP (ML1-5, WL1-5)

- European Short-Term Rate Futures (ESR)

- US Treasury Weekly FOPs

- E-Mini Russell 2000 Monday and Wednesday Weekly FOP (R1A-5A, R1-5C)

- Natural Gas Weekly Financial Options (LN1-LN5)

Intercontinental Exchange (ICE)

- US Conforming 30 Year Fixed Mortgage Index Futures (30C)

- ICE ENDEX Dutch TTF Natural Gas Monthly Futures (TFM)

Members Exchange (MEMX)

- Options

EUREX

- MSCI Taiwan NTR USD Index Futures (FMTW)

- MSCI India NTR USD Index Futures (FMIN)

- MSCI China NTR USD Index Futures (FMCH)

- Euro STOXX 50 Index EoD Options (OEXP)

Euronext

- Options on Rapeseed Futures (OCO)

Hong Kong Futures Exchange (HKFE)

- HKFE MSCI India Index Futures (MND)

Korean Stock Exchange

- KSE KOSPI 200 Monday Weekly Index Options (AF)

Taiwan Stock Exchange (TWSE)

- Taiwan Stock Exchange (TWSE) is now accessible from the Interactive Brokers platform.

Osaka Stock Exchange (OSE)

- OSE N225 Micro Futures (N225MC)

- OSE N225 Mini Options (N225M

Singapore Exchange (SGX)

- SGX Thai Baht in US Dollar Futures (SGXTU)

National Stock Exchange of India (NSE)

- NSE Nifty Financial Services Index Futures (FINNIFTY)

New Tools

New Features Added

to IBKR Trading Platforms

IBKR Trader Workstation (TWS)

- Tax Loss Harvesting for Traders: We are pleased to introduce our Tax Loss Harvest tool to our retail traders. Traders can use this tool to realize the tax benefits of both long- and short-term capital losses more easily.

To open the tool, right-click a position and select Tax Loss Harvest. To use Multi-Stock harvesting, open the Classic Layout and from the Portfolio page click Tax Loss Harvesting in the top right of the Portfolio page.

NOTE: Multi-Stock TLH is currently available only in the Beta build of TWS.

Find out more about using Tax Loss Harvesting in the TWS Release Notes. - Tell Us What You Want: We are pleased to announce the new Feature Suggestion tool in TWS. Now you can easily let us know what features you would like to see added to our platforms and vote on features suggested by others.

To access the Feature Suggestion tool, click the Feedback icon in the title bar of TWS and then click "I have a suggestion." - Futures Roll Builder: We streamlined the multi-step process of rolling a futures position (i.e., closing one position and opening a new one in the same contract but with a more distant expiration) into a simple flow using the new Futures Roll feature.

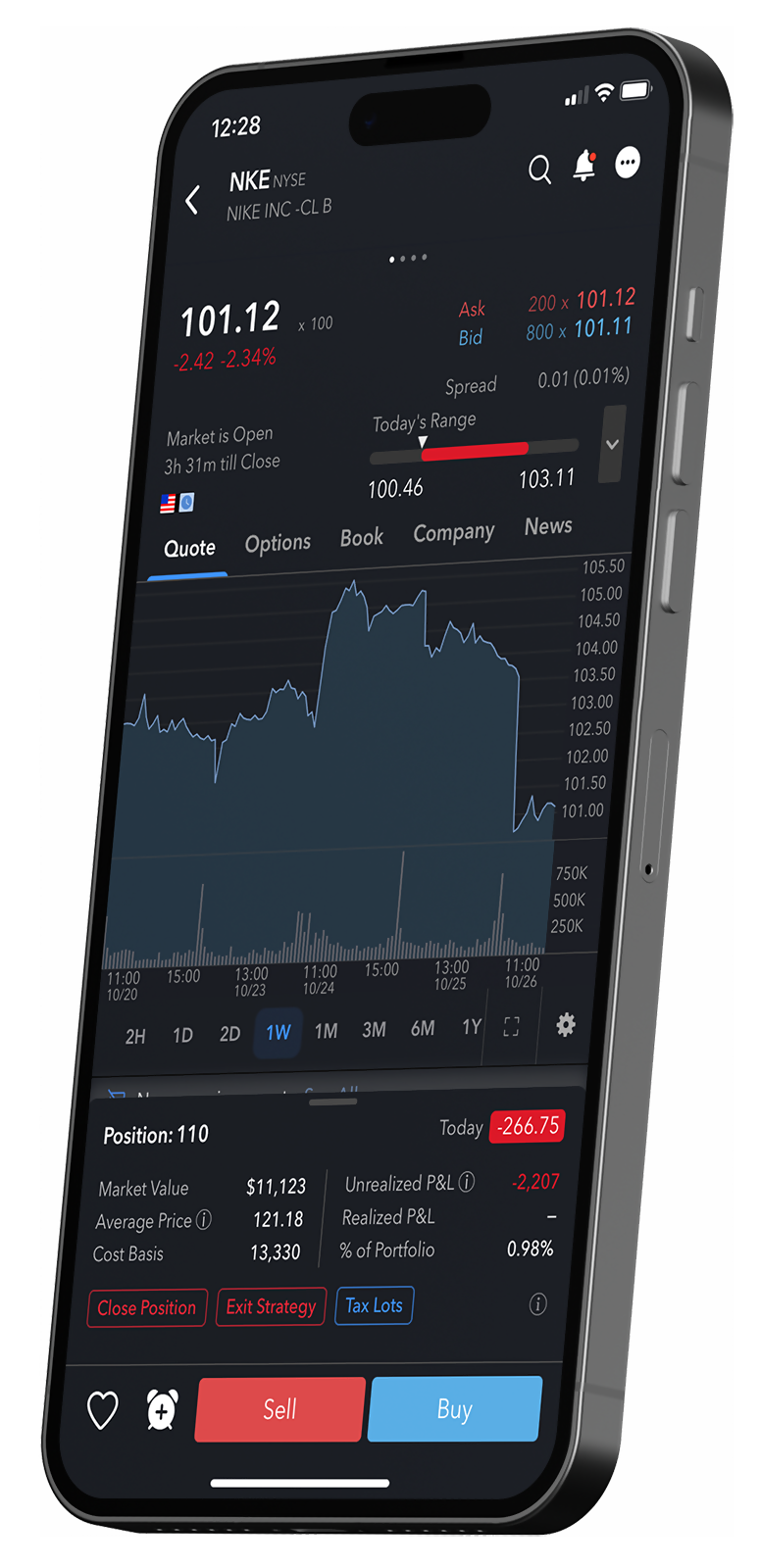

IBKR Mobile

- A new dashboard-like design allows customization for any level of trader. In addition, there are improved access shortcuts and widgets that let you personalize the app.

- A watchlist carousel displays the closing prices of favorite tickers, along with simplifed watchlist building via Stock Scanner.

- All market-moving information is centralized in a single menu, with a heat map to show sector performance aligned to indices and market trends to see top market movers at a glance.

- Quick, dedicated access to educational content from IBKR Campus.

Client Portal

- Redesigned News & Research tool: A completely re-imagined News & Research interface has been released to Client Portal and will soon be available across all IBKR trading platforms. This new interface allows you to create custom feed views of the news you want to read, in the layout style that you prefer.

To access this new layout, from the Research menu select News & Research. This new presentation is easy to navigate and provides a clean, modern interface. - Overnight Trading: Capture market opportunities anytime with Overnight Trading. All clients with US Stock trading permission will have access to US Overnight Trading. To use this feature, in the Order Ticket select Overnight from the Time in Force list.

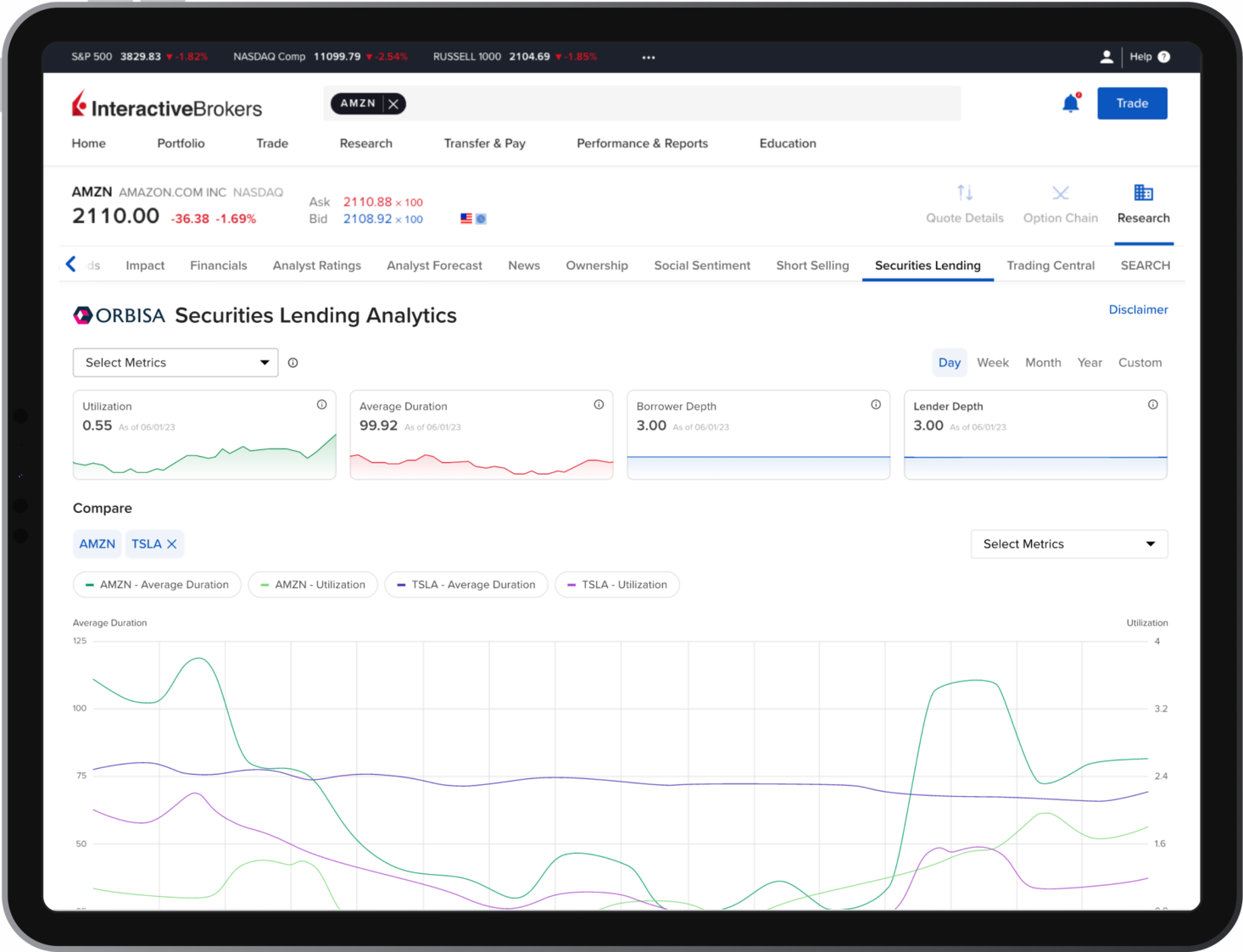

- Orbisa Securities Lending Analytics Dashboard: Now get access to the same valuable short securities lending data for US equities historically available only to banks, broker-dealers and institutional investors. The Orbisa Securities Lending Analytics Dashboard in Fundamentals Explorer gives you professional-level access to key metrics and data to see when borrowing demand is increasing or decreasing so you're better able to gauge in which direction market sentiment is trending.

- QR Code Login Support: Users who use two-factor authentication via IB Key can now log in using a QR code in cases where the IB Key notification is not received. To use, click "Log in with QR Code" directly below the "Resend notification" link in Client Portal.

- Trailing orders: Client Portal now supports Trailing Stop and Trailing Stop Limit orders.

Enhancements for Advisors

Trader Workstation (TWS)

- The Allocation Order Tool now supports options combos.

- Advisors can now choose between "Static" and "Dynamic" methods of applying allocations across models. Static allocation applies the initial percentages to all new investments, while Dynamic allocations apply the new percentages that result from price changes.

- Multi-Stock Tax Loss Harvesting: Updates to the Tax Loss Harvesting tool allow advisors to take advantage of potential losses across client accounts and multiples securities. Previously the tool showed potential losses for a single stock at a time.

- Advisors can now have the order quantity for an Account Group calculated as a percent of their position for groups with "User-Specified" allocation methods. Account Groups automatically calculate ratios and allocate shares to a pre-defined group of accounts based on a selected allocation method.

Advisor Portal

- We redesigned the Advisor Portal Order Ticket to support Advisor Allocations. Other updates include using a horizontal instead of a vertical layout which adapts better to different screen sizes. The new layout also helps users avoid having to scroll up and down to find fields as they create an order. The vertical orientation is still available from the “Quick” order ticket that displays on the right side of the Client Portal interface.

Scan to download the

IBKR GlobalTrader app

Scan to download the

IBKR Mobile app

Scan to download the

IMPACT app

EXPANDED OFFERING

PortfolioAnalyst

EXPANDED OFFERING

New Funds and Fund Families

Available at the Mutual Fund Marketplace

Global Fund Families

- Abbakus AM

- Azimut Investments (LU)

- Charteris Treasury Portfolio Mgrs.

- Flossbach Von Storch

- FIDELITY INV INT'L

- Goldman Sachs Asset Management

- JUPITER AM (EUROPE) LT (IE)

- JUPITER UT MGRS LTD (GB)

- Kepler Partners (LU)

- Rigsave Capital

- Three Rock Capital Management Ltd

- UBP (GENEVA)

- VT Momentum Invest

US Fund Families

- Absolute Investments

- Advisor Series Trust Funds

- Chase Funds

- Conquer Risk Funds

- Curasset Funds

- FundVantage Trust

- FundX

- Glenmead Funds

- M3Sixty Fund

- Muhlenkamp Funds

- Mundoval Fund

- Pabrai Funds

- Perritt Funds

- PIA Funds

- TFS Trust Funds

- Villere Funds

EXPANDED OFFERING

Additional News and Research

Providers Available on the IBKR Platform

Smart Investors Never Stop Learning

New and Updated Courses

Featured Webinars

Featured Articles

Featured Articles

New Features

IBKR AWARDS 2023

An Award-Winning Year!

For the 6th year in a row, Barron's named Interactive Brokers as #1 – Best Online Broker

- 5 out of 5 stars Overall

2023 BrokerChooser Best Online Brokers

- Best Online Broker - 2023

- Best Broker for Day Trading - 2023

- Best Stock Broker - 2023

- Best Broker for Investing - 2023

- #1 for Best Online Broker in Singapore: Read More

- #1 for Online Brokers & Trading Platforms in the United Kingdom: Read More

- #1 for Best Online Brokers in India: Read More

- #1 for Best Brokers for ESG Investing: Read More

2023 StockBrokers.com Review

- #1 Professional Trading

- #1 Active Trading

- #1 Futures Trading

- #1 International Trading

- #1 Investment Options

- #1 Platform Technology

- #1 Sentiment Investing

- #1 ESG Investing

- 5 out of 5 stars Mobile Trading Apps

- 5 out of 5 stars Investment Options

- 5 out of 5 stars Platforms & Tools

- 5 out of 5 stars Research

2023 ForexBrokers.com Online Broker Review

- 4.6 out of 5 stars Overall

- Best Broker for International Trading

- Best Online Broker for Advanced Traders

- Best Online Brokers for Bonds: Read the full article

- Best Overall Broker for Mutual Funds: Read the full article

2023 Preqin Awards

- Featured as a Top Prime Broker

- Featured as a Top Hedge Fund Custodian

2023 Investing in the Web Global Broker Awards

- Best Broker Overall

- Broker with the Lowest FX Fees

- Best Broker for Bonds

- Best Broker for Corporate Accounts

- Best ESG and Impact Investing App (for IMPACT, by Interactive Brokers)

- Best Broker for LLCs

- Best European Trading Platform

- Best Trading Platform in the UAE

- Best Investing Platform in the UK

2023 Good Money Guide Awards

- Best Bond Broker

- Best Futures Broker

- Best Options Trading Platform

2023 Australian Finder Awards

- Share Trading Customer Satisfaction Winner

- Best for Global Stocks

- Best for Active Traders