Prop Trader Onboarding

Proprietary Trading Groups Welcome Center

IBKR offers trading, clearing, custody and reporting with no long-term contract required.

This page provides information and resources to help you configure and customize your account, onboard, and manage clients, fund accounts, subscribe to market data, run reports, trade and more.

Getting Started

Portal serves as a one-stop destination for managing accounts, viewing account balances, P&L and key performance metrics, funding accounts, reporting, and more. Portal is always available from the Login button on our website.

Configuring Your Account

User Access Rights

Once your account is approved and opened, your organization's security officer(s) can create and add users to an account, manage user access to account trading, reporting, funding, and settings, and configure client-specific access.

Account Funding & Structure

Account Funding

The Transfer & Pay menu in Portal provides resources to let you transfer funds, transfer positions, and check transaction status and history. Additionally, you can submit withdrawals for both your master account and sub accounts.

Our website provides an overview of funding methods available to clients.

Prop Trading Account Structure

IBKR offers Proprietary Trading Group accounts for corporations, partnerships, limited liability companies and unincorporated legal structures.

Organization Account

A single trading account with one or more users. Multiple users can view and modify other traders' activity.

-

User

-

User

-

User

-

Trading Account

Separate Trading Limit Account

Multiple, linked accounts all in the name of a single entity. Assets in all accounts are owned by the entity account holder. Each account has its own trading limits and can have its own trading strategy.

Master, sub accounts and users are part of the same legal entity.

Funds are deposited in the master account and transferred between the master and sub accounts to control individual trader limits.

Initial margining is determined for each individual account, while maintenance margining is determined at a consolidated account level.

Master users can set trading limits on individual sub accounts based on order size and value.

-

Supervisory User

-

Supervisory User

-

Supervisory User

-

Master Trading Account

-

Sub Account

-

Sub User

-

-

Sub Account

-

Sub User

-

-

Sub Account

-

Sub User

-

-

Performance & Statements

Performance & Statements

The Performance & Statements menu in Portal provides access to PortfolioAnalyst®, standard Statements, Flex Queries, Tax Documents and more.

- Transaction Cost Analysis (TCA): TCA tracks the quality of your orders' transaction prices versus market conditions either at the time the orders were submitted or after the trade executes.

- Tax Optimizer: Tax Optimizer lets you change your tax lot-matching method to optimize your gains and losses.

Account Security

Account Security

We are committed to protecting accounts from fraudulent practices. Prop Traders need to be authenticated with our Digital Security Card+.

iOS Tutorial:

Please note that Clients of Prop Traders can download the iOS Mobile App, however, Prop Traders do not have direct access to this tool.

Android Tutorial:

Please note that Clients of Prop Traders can download the Android Mobile App, however, Prop Traders do not have direct access to this tool.

Configuring Market Data

Market Data

Use the Settings menu in Portal to manage your market data, research and news subscriptions. We provide real-time streaming market data for free or at the price we are charged by the exchange and offer access to dozens of free and premium market research and news providers.

Trade Your Account

Trading Platforms

Trader Workstation (TWS)

Our flagship desktop platform designed for active traders and investors who trade multiple products and require power and flexibility.

Trader Workstation (TWS)

Our flagship desktop platform designed for active traders and investors who trade multiple products and require power and flexibility.

TWS Layout/Customization Tutorial:

TWS Setup Window Tutorial:

IBKR ATS

Customers can direct US stock orders to the IBKR ATS destination to add liquidity. Orders directed to IBKR ATS are automatically tagged as "not held" orders, and are posted in IBKR's order book where they are eligible to trade against incoming SmartRouted orders that are marketable against them.

A variety of order types are available for posting liquidity in IBKR ATS, including Pegged-to-Midpoint, Pegged-to-Best, Relative/Pegged-to-Primary, and Pegged-to-Market, as well as priced limit orders.

IBKR ATS for Prop Traders:

IBKR Mobile

Easily trade and monitor your IBKR account on-the-go from your iOS or Android device (tablet or smartphone).

IBKR Mobile

Easily trade and monitor your IBKR account on-the-go from your iOS or Android device (tablet or smartphone).

IBKR Mobile for Prop Traders:

IBKR APIs

From easy-to-use Excel API to IBKR’s industrial strength FIX API, IBKR offers APIs for every experience level.

IBKR APIs

From easy-to-use Excel API to IBKR’s industrial strength FIX API, IBKR offers APIs for every experience level.

Other Features

Account Window

A configurable window in TWS for monitoring every aspect of your account activity.

Monitor Positions

The Monitor panel on the TWS houses your watch lists and your Portfolio page so you can quickly access a real-time view of your positions, P&L, liquidity, margin requirements, etc.

Rebalance Portfolio

Use the TWS Rebalance window to rebalance your portfolio based on the target percentages you enter.

Pre-Trade Compliance

Use the Pre-Trade Compliance (PTC) tool to set trading restrictions and controls on the account or individual users with account access.

Paper Trading Account

Use the full range of trading facilities in a simulated environment using real market conditions.

Investors' Marketplace

The Investors’ Marketplace lets brokers advertise their services to IBKR clients and connect with third party suppliers of technology, research, consulting and investment services. Our website provides an overview of funding methods available to clients.

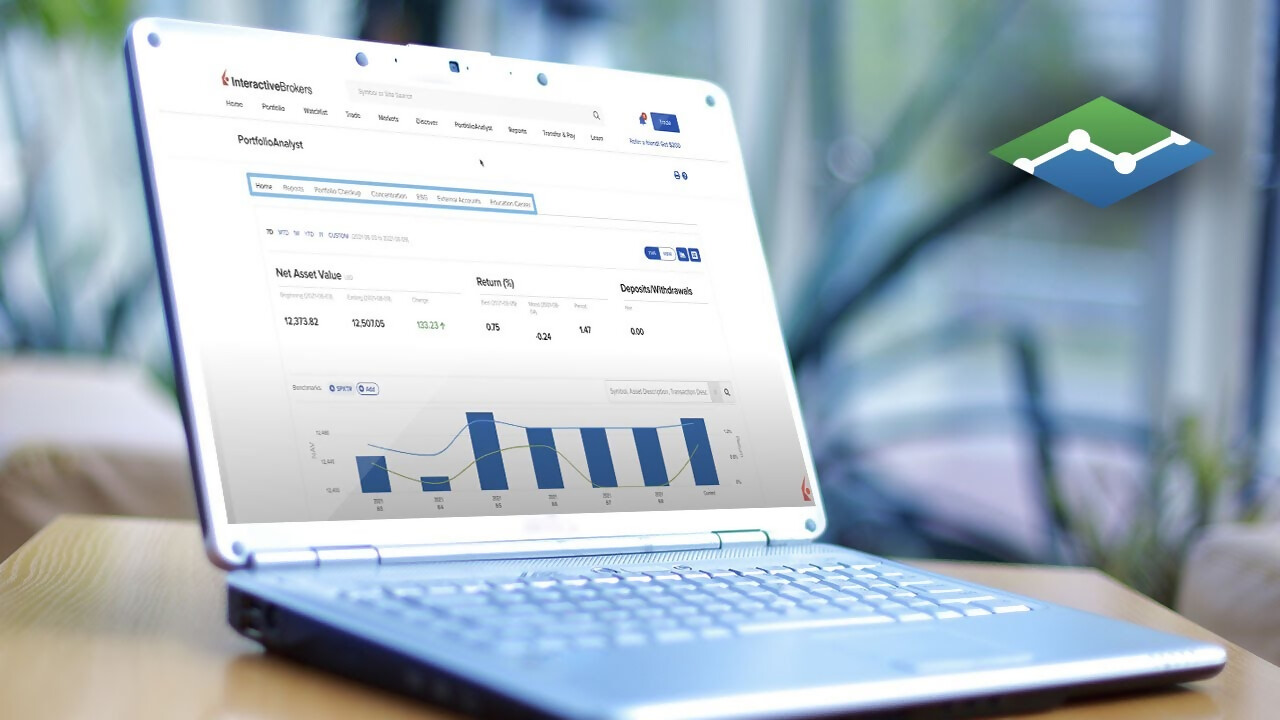

PortfolioAnalyst

Use Portal to access PortfolioAnalyst, a comprehensive portfolio management tool that helps you quickly and easily consolidate clients’ financial information from any financial institution to gain a complete portfolio view, including assets held-away.

For information on other features, including Trade in Fractions, IBKR GlobalAnalyst and the Bonds Marketplace, visit our Features in Focus webpage.

View All Features in FocusSupport Resources

Frequently Asked Questions

Looking for an answer? Browse our extensive inventory of frequently asked questions.

IBKR Campus

Learn about the tools, markets and technology available to you as a broker on the IBKR Platform. Stay on top of market events at Traders Insight, learn about programming at the Quant Blog, subscribe to our Podcast channel for interviews and audio articles covering the world of finance, or sign up for a complimentary webinar.

Global Product Offering

Invest globally in stocks, options, futures, currencies and bonds from a single unified platform.

Margin Trading

IBKR offers margin rates from USD 4.83%-5.83%, the lowest margin loan interest rates of any broker,according to the StockBrokers.com Online Broker Survey 2023 Read the full article.

Support for Institutions

Browse our support page for instructional videos, user guides, release notes and information on connecting with us.